The Valparaíso Palace still towers over Palma Bay. But the Chinese owner GPRO is suddenly seeking partners for a comprehensive renewal. Why a well-capitalized company wants investors on board — and which questions remain unanswered.

Valparaíso before a New Beginning — or a Farewell?

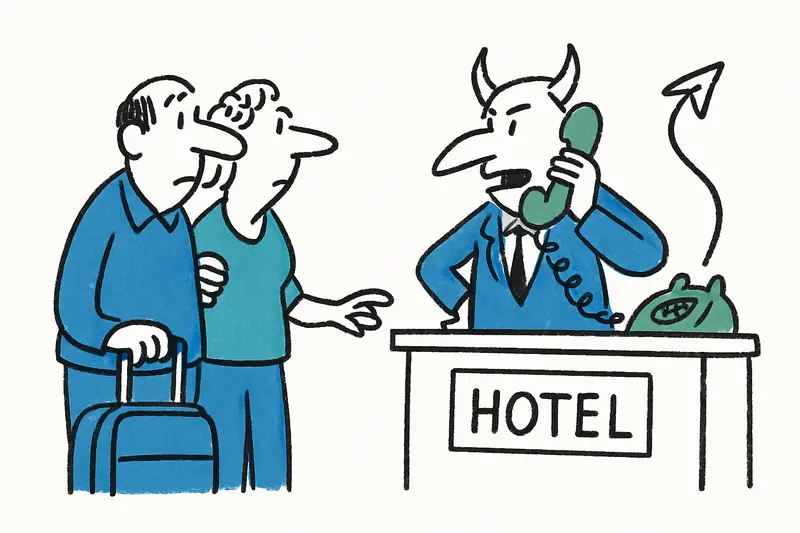

Leading question: Why is the well-capitalized GPRO asking for partners when the hotel enjoys one of Palma's best locations?

On the Paseo Marítimo, when the wind from the bay brings the scent of the sea and motorcycles quiet down because riders are taking a look at the cliffside, the Valparaíso still stands exactly as it has for decades: on a cliff, with views of the cathedral and the sailboats. Anyone who walks down the stairs to the hotel garden in the morning hears birds, water from the artificial waterfall and the soft clink of coffee cups. The external address is perfect. Inside, however, time creaks.

Quick facts: The property opened in 1974, has 174 rooms, and about 20,000 square meters of gardens including a waterfall. A severe fire in 1995 destroyed around 100 rooms; there were renovations afterwards, but apparently never a complete redesign. Since 2014 the estate has belonged to the Chinese GPRO group, reportedly for €48 million. Now GPRO wants to fundamentally renew the hotel and attract an international luxury brand as operator — and is simultaneously looking for financial partners. Which raises the question again: Is this just a typical modernization plan, or is there more behind it?

Critical analysis: That an owner seeks capital for a project is initially unspectacular. What seems odd here is that GPRO is regarded as liquid within industry circles. The involvement of DC Advisory, a subsidiary of the Japanese Daiwa group, is a clue: such advisors bring contacts to international investors and structure transactions that can go beyond a simple renovation. Two scenarios appear plausible: first, GPRO wants to raise the hotel to international franchise standards for long-term operation and share risks and costs with partners. Second, the group is preparing for a partial or complete sale and increases attractiveness by investing in advance.

The industry quietly speculates: a large brand operator (examples would be Four Seasons, Mandarin Oriental, Hyatt or IHG) would quickly lift the Valparaíso to another level. The hotel would then attract international guests and command higher rates. But a brand change also alters the workforce, supply chains, local relationships — and often the prices for guests who were formerly regulars.

Public debate: What is missing so far in the discussions is transparency toward the city and the neighbors. Will the renewal be a partially closed, phased measure, or is a complete closure planned? What urban planning interventions are required, which permits are in place? How will the gardens and the waterfall — part of the public image for many — be preserved? And: what guarantees exist for the preservation of jobs and for local suppliers?

A slice of everyday life: On a gray morning a cleaning worker sits at the café in front of the hotel, sips an espresso and says she has worked there for 20 years. She fears temporary contracts or retraining if a new operator arrives. Around the corner two older Mallorcans discuss rising hotel prices in the park; they remember times when the Valparaíso had a different clientele. Such voices often remain invisible in the big announcements.

Concretely, three things are missing: comprehensible financial plans, reliable information on the duration of construction work and clear signals on how staff and local businesses will be treated. Without this information, speculation — and unrest in the neighborhood — will continue.

Concrete solutions: 1) The city of Palma should insist on an early, transparent dialogue phase: public information events, access to permit plans and environmental assessments. 2) A phased renovation concept minimizes operational interruptions and protects jobs. 3) Investor and operator contracts should include clauses to preserve part of the existing staff and to favor local suppliers. 4) Garden and landscape protection as a condition: the 20,000 sqm of green space should not be treated as interchangeable building land. 5) Public control mechanisms for tax obligations and tourist capacity limits so that the modernization does not become a short-term speculation object.

Conclusion: The Valparaíso is a city-defining hotel with historical weight and an excellent location. The search for investors can be a sensible way to secure the substance and position the house for the present. But it can also mark the beginning of an ownership change more interested in returns than continuity. Those who walk along Palma's promenade should therefore not only enjoy the view but also ask: who owns the view — and who will ultimately own the jobs, the gardens and the public values that make this hotel? Without answers, the announced renewal remains a big question mark over the bay.

Read, researched, and newly interpreted for you: Source

Similar News

Traffic stop in Palma: 171 pills, two arrests – how safe are our streets?

During a traffic stop in Palma, ECOP officers seized 171 MDMA pills, Tusi doses, cash and a notebook. What does the inci...

New Year's Eve in Mallorca 2025: Glamour, Culinary Delights and Cozy Alternatives

From Can Bordoy to Palma Bellver: where the island celebrates the new year — gift ideas for different budgets, local det...

Mallorca 2026: Early-Booking Boom – A Vicious Cycle for the Island, Hoteliers and Residents?

Tui reports strong early-booking numbers for 2026; families secure discounts and children's rates. Why that looks good i...

Esther Schweins Reads for Charity at Bodega Binivista

On Saturday at 6:00 pm actress Esther Schweins will read at Bodega Binivista in Mallorca from 'The Mathematics of Nina G...

Alcúdia: Who Was Really at the Wheel? A Reality Check on Alcohol, Responsibility and Investigations

In the fatal crash on the Ma-3460 on November 15, a 53-year-old Dutch man died. He initially claimed to have been drivin...

More to explore

Discover more interesting content

Experience Mallorca's Best Beaches and Coves with SUP and Snorkeling

Spanish Cooking Workshop in Mallorca