Employee allegedly defrauded company in Palma with forged invoices for €150,000

An employee in Palma is suspected of having created forged invoices since mid-2024 and redirected supplier account details to her own account. The National Police launched an investigation after an expense audit revealed irregularities.

Employee in Palma allegedly harmed company with forged invoices totaling around €150,000

Key question: How could so much money flow away unnoticed over months?

The National Police arrested a woman in Palma who, according to investigators, has apparently been systematically creating fake invoices and changing the bank details of real suppliers to her own account since mid-2024. In total, roughly 60 manipulated invoices are said to have been issued. The case came to light during a routine expense audit; the accused was charged with fraud and forgery and is currently released pending further proceedings after a judge's decision, as described in Detención en Palma tras una serie de presuntas transferencias fraudulentas en hoteles de lujo.

This is a calculation that voices in companies and administration on Mallorca quickly make: 60 invoices spread over months add up to a six-figure sum. To outsiders this may seem like a relatively simple manipulation method, but the consequences are significant — for the harmed company, for employees and for trust in the local business community; similar local cases were also reported, for example Manacor: una mujer habría desviado más de 80.000 euros de la caja de la empresa.

Critical analysis

The case reveals typical weaknesses: lack of segregation of duties, lax procedures when changing bank details and insufficient control in supplier management. If a single employee has access to supplier data and the authorization to approve payments, an entry point is created. Invoice checks that focus only on formalities may not detect that the bank account has been manipulated.

Another aspect is timing. Fraud that unfolds over months suggests that internal audits at the company are either infrequent or only sporadic and predictable. Many small and medium-sized enterprises on Mallorca also operate in highly seasonal business cycles — during busy periods controls often fall by the wayside.

What is often missing in public debate

Reports often emphasize individual blame while giving less weight to structural causes. Yet it is organizational gaps that make such cases possible in the first place: unclear approval paths, lack of automated checks and a culture in which mistakes are more likely to be covered up. There is also a lack of practical guidance for business owners and employees: how can you spot patterns that indicate invoice fraud? Who outside the accounting department should be allowed to raise the alarm? For related incidents and different modalities of alleged fraud in the area see Palma: mujer detenida — casi 68.000 euros perdidos por estafa con criptomonedas.

An everyday scene from Palma

On Passeig del Born on a cold morning the smell of coffee from the little shop next to the notary is noticeable, delivery drivers stop briefly and delivery notes are quickly stamped. In a back room of an office building near the Plaça de Cort an accountant with headphones scrolls through invoice files and marks perceived inconsistencies — that is what everyday work looks like. It is precisely in these routines that weaknesses hide: fatigue, time pressure and trust can mean changes to account details are not always thoroughly checked.

Concrete solutions

1) Strictly enforce the four-eyes principle: any change to bank details and any larger payment must be reviewed and approved by two independent people.

2) Verification via an external channel: for account changes, make a confirmation call to the known company contact or request a confirmed email to a registered address.

3) Supplier portal and audit trail: centralize all invoices, store version histories and IP logs; automatically flag unusual patterns (multiple invoices to a new account).

4) Regular, unannounced expense audits: spot checks and digital analyses reduce predictability for fraudsters.

5) Training and whistleblower protection: raise employee awareness, enable and protect anonymous tips so irregularities are more likely to be uncovered internally rather than later by the police.

6) Cooperation with banks: in cases of unusual returns or changed recipient data, banks and companies should be able to exchange information more quickly within legal limits.

What matters now

The public prosecutor's office and the courts will examine the concrete sequence of events. For the affected company, however, the immediate task is to limit the financial and reputational damage and strengthen internal procedures. Accounting and purchasing staff should take the case as a wake-up call: control is not an exercise in distrust, but protection for the company itself.

Conclusion: The allegation in Palma is not an isolated incident but a lesson in internal control. Anyone doing business on Mallorca should do their homework: clear processes, digital traceability and courageous checks. That protects against economic crime and preserves trust — in the small cafes as well as in the offices along the ramblas.

Read, researched, and newly interpreted for you: Source

Similar News

27 years, a 'Yes' and the island as witness: Peggy Jerofke and Steff Jerkel celebrate on Majorca

After a long period of ups and downs, Peggy Jerofke and Steff Jerkel plan to marry on June 26 in the east of Majorca. A ...

Jan Hofer on Mallorca: Homesick for Wholegrain — Yet Settled

The 75-year-old TV veteran lives on the island with his wife, takes small homeland trips to Can Pastilla and sometimes m...

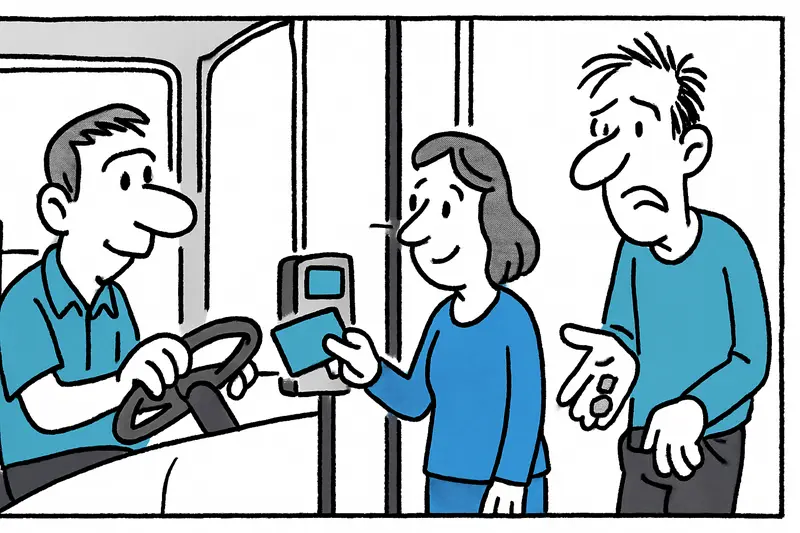

Card payments on Palma's city buses – relief or nuisance?

EMT is rolling out card readers in Palma's buses: about 134 vehicles already equipped, group discount rules — but also t...

Knee-high water at Playa de Palma: What to do about the recurring floods?

Torrential rainfall flooded the Playa de Palma, with walkways knee-deep in water. An assessment of what's missing and ho...

Llucmajor gets beaches ready: new signs, pruned palms and preparations for the summer season

Llucmajor is preparing for the bathing season: palms in s'Arenal have been trimmed, 16 bathing areas will receive inform...

More to explore

Discover more interesting content

Experience Mallorca's Best Beaches and Coves with SUP and Snorkeling

Spanish Cooking Workshop in Mallorca