Insurance Fraud in Palma: Three Arrests After Car Fire — What This Means for the Island

Three men were arrested in Palma on suspicion of insurance fraud. A car worth around €60,000 burned out, and the owner is said to have faked a theft. Read why this case raises more questions than answers.

Main question: How easily can money be made on Mallorca through arson and false reports — and why do we only notice once the flames have been extinguished?

Police sirens and flashing lights in the middle of Palma are not uncommon, but the latest case carries particular weight: three men were arrested after apparently setting fire to a car worth around €60,000 Attempted Insurance Fraud in Mallorca: Who Sets Fires — and Why the System Fails. The vehicle was discovered completely burned out a few days later in a hospital parking lot. According to police statements, the owner is said to have pretended the car was stolen in order to collect the insurance payout. One suspect reportedly left the car parked and was later picked up by an accomplice.

Those are the sober facts. But between the photos of flashing lights and the press release lies a bigger problem: it is not just about a single car, it is about systems that can be abused — from reporting an alleged theft to paying out an insurance claim.

Critical analysis: procedural gaps and incentives for fraud

Insurers do not inspect every claim on site. When a vehicle is reported stolen and later found destroyed, investigators and insurers face complex questions: when was the car stolen, who last had access, and how plausible is the owner's statement? On Mallorca, where many vehicles are used seasonally or parked by secondary owners, such gaps can be more easily exploited. Added to that is the fact that arson destroys evidence — precisely what alleged perpetrators reportedly intended.

Parking lots in front of hospitals, supermarkets or tourist centers are often poorly monitored. Parking a car at night, walking away and arranging to be picked up later — the report describes a simple tactic. If money is the motive, a dangerous calculation emerges: a high vehicle value plus an insurance claim can represent a potential profit that makes the risk attractive to offenders.

What is missing from public discourse

Reporting usually mentions arrests and sums; for other recent high-profile arrests on the island see Three arrests in Mallorca: What lies behind the alleged international bank fraud. What is often missing are three things: figures on how frequently such cases occur on the island, information on how insurers examine suspicious cases, and clear guidance on what prevention measures municipalities or hospitals could implement. Little discussed is also the role of tow companies, garage owners and private parking operators: how is it documented who parked a vehicle? Who bears which responsibility?

Everyday scene from Palma

Imagine a November morning on the Paseo del Born: delivery vans rumble by, cups clink at the corner café, a taxi driver smokes briefly before driving off. Routine prevails in the hospital car park three streets away — patients get in, relatives wait. No one expects that a burned-out car will be found right there, whose story reveals a chain of false statements and alleged arson. That gap between normality and crime is what unsettles people most in everyday life.

Concrete solutions

1) Insurers should increasingly use digital proof methods: timestamped photos, logbooks or telematics data can help refute false theft reports; see examples in the usage-based insurance (telematics) overview. 2) Hospitals and larger parking areas could set up certified documentation points — simple barrier cameras, a digital check-in via QR code or a log-style recording of all parked vehicles. 3) Police and public prosecutors need specialized investigation teams for insurance fraud; fire cause investigations should be prioritized because fire destroys evidence, see fire investigation guidance. 4) Public communication: if insurers are more transparent about the documents required, fraud becomes less attractive. 5) Cooperation: police, insurers, municipalities and private operators must agree on reporting chains and verification mechanisms so that suspicious cases are detected more quickly; international frameworks and best practices are discussed in Interpol financial crime resources.

Conclusion: More than just a burned-out car

The case in Palma is more than a crime report. It is a warning signal: when economic incentives and weak documentation chains meet, spaces for fraud are created. We cannot prevent every act — but we can change structures so they become less lucrative. For the island this means concretely: better documentation in parking areas, more modern verification procedures at insurers and closer cooperation among stakeholders. Otherwise, after the last flame is extinguished only the costly question remains: who actually pays for the damage — and who pays for the lost trust?

Read, researched, and newly interpreted for you: Source

Similar News

27 years, a 'Yes' and the island as witness: Peggy Jerofke and Steff Jerkel celebrate on Majorca

After a long period of ups and downs, Peggy Jerofke and Steff Jerkel plan to marry on June 26 in the east of Majorca. A ...

Jan Hofer on Mallorca: Homesick for Wholegrain — Yet Settled

The 75-year-old TV veteran lives on the island with his wife, takes small homeland trips to Can Pastilla and sometimes m...

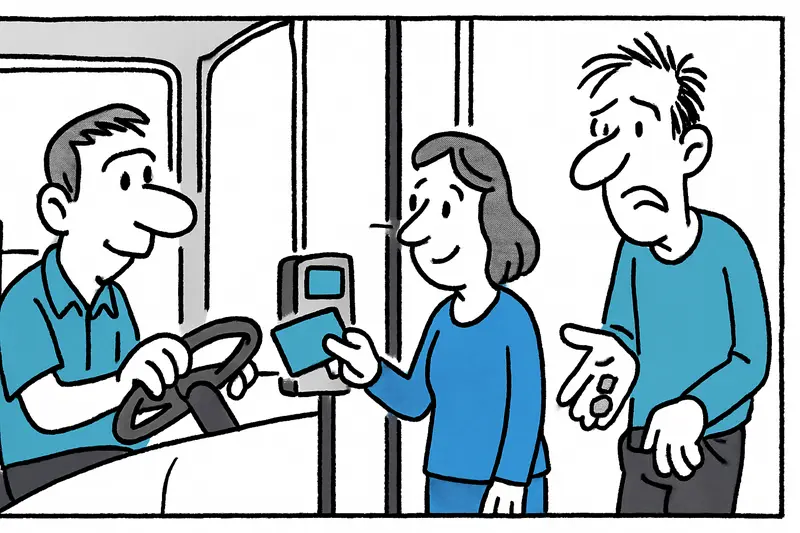

Card payments on Palma's city buses – relief or nuisance?

EMT is rolling out card readers in Palma's buses: about 134 vehicles already equipped, group discount rules — but also t...

Knee-high water at Playa de Palma: What to do about the recurring floods?

Torrential rainfall flooded the Playa de Palma, with walkways knee-deep in water. An assessment of what's missing and ho...

Llucmajor gets beaches ready: new signs, pruned palms and preparations for the summer season

Llucmajor is preparing for the bathing season: palms in s'Arenal have been trimmed, 16 bathing areas will receive inform...

More to explore

Discover more interesting content

Experience Mallorca's Best Beaches and Coves with SUP and Snorkeling

Spanish Cooking Workshop in Mallorca